Employee Share Ownership Plan (ESOP)

This page is to help you get familiar with Banff Lodging Company’s ESOP. You’ll learn about the eligibility requirements for participation, the basic terms and conditions of our ESOP, and how the program is administered.

Our principal owner, Wim Pauw, wanted to establish a plan to ultimately transition ownership of Banff Caribou Properties to employees, as a way of perpetuating local ownership in the company and “keeping Banff in Banff”. The Employee Share Ownership Program (ESOP) was launched in 2008, motivated in large by the founding shareholder’s vision to create a meaningful opportunity for employees to invest in their workplace and save for retirement.

I’m not a Canadian citizen. Can I still invest in the ESOP?

Yes, you do not need to be a Canadian citizen or permanent resident to invest in the ESOP.

What is the eligibility criteria to become a shareholder?

In order to become a shareholder, you are required to have completed 2 full years of employment prior to February 1st, and worked a combined minimum of 3,000 hours over the past 2 years.

What is the minimum subscription amount?

The initial subscription to become a shareholder is $5,000. Once a shareholder, the minimum subscription is $1,000. Annual subscriptions are not mandatory.

If I go on job protected leave can I still invest?

Employees on job protected leave can continue to hold shares while on leave. However, in order to subscribe to purchase additional shares, the minimum hour criteria must be met.

How do I subscribe to purchase shares?

You’ll need to complete an ESOP subscription agreement that confirms how much money you’d like to invest in ESOP in the upcoming year and how you will pay for the shares.

Can I purchase shares at any time?

Shares can only be purchased between October 1st and February 1st of each year. Payment is due in full by October 31st.

How much can I invest into the ESOP each year?

The maximum amount that can be invested by an hourly employee is 40% of Box 14 on their prior year T4. Salaried employees may invest up to 40% of their total compensation for the current year.

The minimum subscription amount is $5,000 to become a shareholder and $1,000 per year once a shareholder. Annual subscription’s are not mandatory.

How much do shares cost?

Shares are valued and issued at Fair Market Value. Shares are only valued once per year based on the prior year’s audited financial statements.

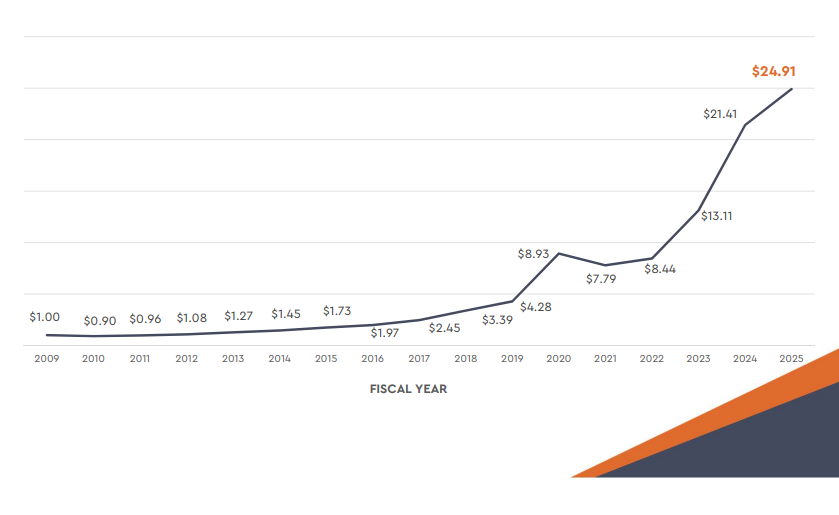

This graph shows the yearly share price since the ESOP program began.

What options do I have to pay for the shares?

You may pay for your shares by making a lump sum payment to the payroll department by cash or cheque, or you can request that a standard amount is deducted from your pay cheque throughout the year. You may also use any future bonus to purchase shares, allocate a portion of your total compensation (salaried employees only). Payment must be made in full by October 31st, and the aforementioned methods of payments may be combined.

Can I use my anniversary bonus to pay for shares?

Yes, you may use your anniversary bonus to contribute to your share purchase.

What happens if I can’t afford to pay for all of the shares I subscribed to purchase?

The deadline to pay for shares is October 31st and your subscription is a commitment to paying the aggregate subscription price in full. If, due to unforeseen circumstances, you are not able to pay for your shares in full, the Board will determine appropriate action to remedy the situation.

What if I sign my subscription form and I leave the company before my shares are issued?

Any monies collected will be refunded back to you in the same form payment was taken.

How can I learn about the performance of my shares and the Company?

As a shareholder, you will be invited to attend the annual ESOP Shareholder Meeting, normally held in April. At this meeting, the Executive team shares an overview of the previous and upcoming year’s significant capital, operational, and sales activities. The new share price and any changes to the ESOP program are also announced.

Will I get to go to the meetings and vote on the decisions of the Company?

ESOP shares are non-voting shares. However, the Company welcomes your input and you should be more motivated than ever to contribute because any improvements in the operation of the Company will improve the value of the Company and thereby the value of your investment.

Will I get a copy of the Company financial statements?

No, as an investor in the ESOP shares you waive your rights to see the financial statements. The Company financial results are audited and the value of the Company and the shares are determined by independent professionals and approved by the Board of Directors.

Can I sell my shares?

Shareholders that have held shares for 5 years are eligible to sell.

On October 1st of each year, request to sell forms will be made available to shareholders and due by February 1st of each year. The amount requested is not guaranteed. Each year, the board will determine the total cash available for shareholder distributions. Approved payments will be made to shareholders between May 1 – October 31 each year based on cash availability.

The minimum amount a shareholder can request to sell is $5,000 with a maximum of 50% of their shares held. If requesting to sell more than 50%, all shares must be sold and the employee will no longer be able to participate in the share program.

If I leave the company, or I am permitted to sell my shares, what is the process of cashing in my shares? How is this taxed?

A price for your shares will be determined at the time of your departure based on the current HEP and LEP. The amounts received for your shares will need to be reported on your tax return in the year that they are sold.

If you’d like more information about ESOP, please contact Jessica Munn, jmunn@banfflodgingco.com .

The information in this document is correct as of June 15, 2025, and is subject to change without notice. For up to date information, please contact Jessica Munn.

How to Log in to View my ESOP Shares?

To check your ESOP Statement, go to esop.banfflodgingco.com in with your first name and the initial of your last name.

Your password is your SIN.

USERNAME: johnw

PW (SIN): 123456789

Banff Lodging Company

Local: (403) 762-2642

Human Resources Office

229 Suite 300 Bear Street,

PO Box 1070

Banff, Ab, T1L 1H8

Canada